The Irresistible Appeal for International Property Investors: Why London Remains a Top Choice in 2024 London has consistently held its ground as a premier destination for international property investors, and 2024 is no exception. Known for its robust economy, political stability, and cultural vibrancy, London continues to offer unparalleled opportunities for strong capital appreciation and high rental yields. This comprehensive analysis explores the factors solidifying London’s status as a top choice for global investors. It delves deeper into the dynamics that drive its real estate market and how Newbrickz can support investors in navigating this lucrative landscape.

High Demand, Limited Supply: The Engine Driving London’s Market

The London property market is characterised by a persistent imbalance between high demand and limited supply, creating a fertile ground for real estate investment. London’s global appeal as a financial and cultural hub attracts diverse residents and investors, yet the city’s supply of available properties still needs to be expanded. This shortage is driven by several factors, including strict planning regulations, limited land availability, and heritage protections, which collectively constrain new developments (benhams.com) (Joseph Mews).

The ongoing shortage is further exacerbated by London’s steady population growth and its draw as a prime destination for professionals and students worldwide. The housing deficit in the UK, particularly in London, has been highlighted in multiple reports, indicating that the current supply does not meet the growing demand. According to data from Joseph Mews, the UK has a housing deficit of more than 4.3 million homes, with London experiencing significant pressure from this shortfall(Joseph Mews).

Moreover, the city’s popularity among international investors adds another layer of competition, driving up property prices. Despite a slight cooling in some segments of the UK property market due to economic conditions, London remains robust, particularly in prime areas where demand consistently outpaces supply. This supply-demand dynamic is crucial in maintaining London’s status as one of the most competitive and rewarding real estate markets globally(Joseph Mews) (Aspen Woolf).

Strong Capital Growth and Rental Yields: The Core of Investment Appeal

International investors are drawn to London for its status as a global city and for its tangible returns. The potential for strong capital growth and high rental yields is a significant factor driving investment decisions. Historical data shows that London’s property market has consistently delivered capital appreciation, even during periods of economic uncertainty. For example, from 2020 to 2022, property prices in London increased significantly, and while growth has moderated, the market is expected to regain momentum by mid-2024 as economic conditions stabilise (Joseph Mews).

Rental yields in London are equally compelling. A large and diverse population, including a significant number of international students and professionals, buoy the city’s rental market. As of 2024, the average rent in London is approximately £2,121 per month, which is nearly double the UK average. This figure indicates the high rental demand in the city, particularly in central areas and those well-served by public transport (Aspen Woolf) (API Global).

The combination of solid capital growth and reliable rental income makes London an attractive proposition for international investors looking for both short-term returns and long-term value appreciation. Areas undergoing regeneration and those benefiting from infrastructure developments are promising, offering the potential for above-average returns on investment (Turnkey London) (API Global).

A Transparent and Established Legal Framework

One of the key attractions of investing in London is the transparency and stability of the UK’s legal framework surrounding property transactions. The UK’s property laws are among the most robust and well-established globally, offering a high level of protection for investors. Buying property in London is straightforward, with clear regulations governing ownership, leases, and mortgages. The UK Land Registry ensures that property ownership is accurately recorded, reducing the risk of disputes and providing peace of mind for international buyers (API Global).

This legal clarity is essential for international investors, who may be unfamiliar with the intricacies of foreign property markets. The UK’s legal system offers a level of certainty that is highly valued, making London a preferred destination for investors seeking a secure and predictable investment environment (API Global).

Ease of Borrowing and Access to Financing

London’s well-developed financial sector further enhances its appeal to international investors. The city’s status as a global financial hub means that a wide range of mortgage products and financing options are available, tailored specifically for non-residents. Many UK banks and lenders offer mortgages to international buyers, often requiring a down payment of around 20-40% of the property value. This accessibility to finance makes London’s property market more inclusive and attractive to a global audience (API Global).

Moreover, the UK’s stable regulatory environment and established banking system reassure lenders, facilitating credit availability to international investors. The ability to secure financing, even in a high-interest-rate climate, is a significant advantage, enabling investors to leverage their investments effectively and maximize their returns (API Global)(Joseph Mews).

London’s Educational and Employment Magnetism

London’s reputation as an education and employment centre is another powerful draw for international property investors. The city is home to over 40 universities, including world-renowned institutions like the London School of Economics, University College London, and King’s College London. These institutions attract a steady stream of international students, many requiring accommodation, driving demand for rental properties (Aspen Woolf) (Joseph Mews).

In addition to education, London’s vibrant job market, particularly in sectors like finance, technology, and creative industries, attracts professionals from around the globe. This influx of talent ensures a continuous demand for quality rental properties, particularly in well-connected and desirable areas. For international investors, this equates to a stable rental market with low vacancy rates and the potential for higher rental income(Joseph Mews).

Economic Stability and Currency Advantages

The UK’s economic stability, particularly in London, is a critical factor that continues to attract international investors. Despite global economic uncertainties, London remains a beacon of stability, with a resilient economy that supports long-term property investments. The city’s role as a financial hub, coupled with its political stability, makes it an appealing destination for investors seeking a safe and secure investment (Joseph Mews).

Currency fluctuations can also play to the advantage of international investors. A favourable exchange rate against the British pound can significantly reduce the cost of investing in London property, enhancing purchasing power and potentially increasing returns. For example, investors purchasing property with stronger foreign currencies can benefit from lower entry costs, making their investments even more attractive (Joseph Mews).

Regeneration and Infrastructure Development: Shaping the Future

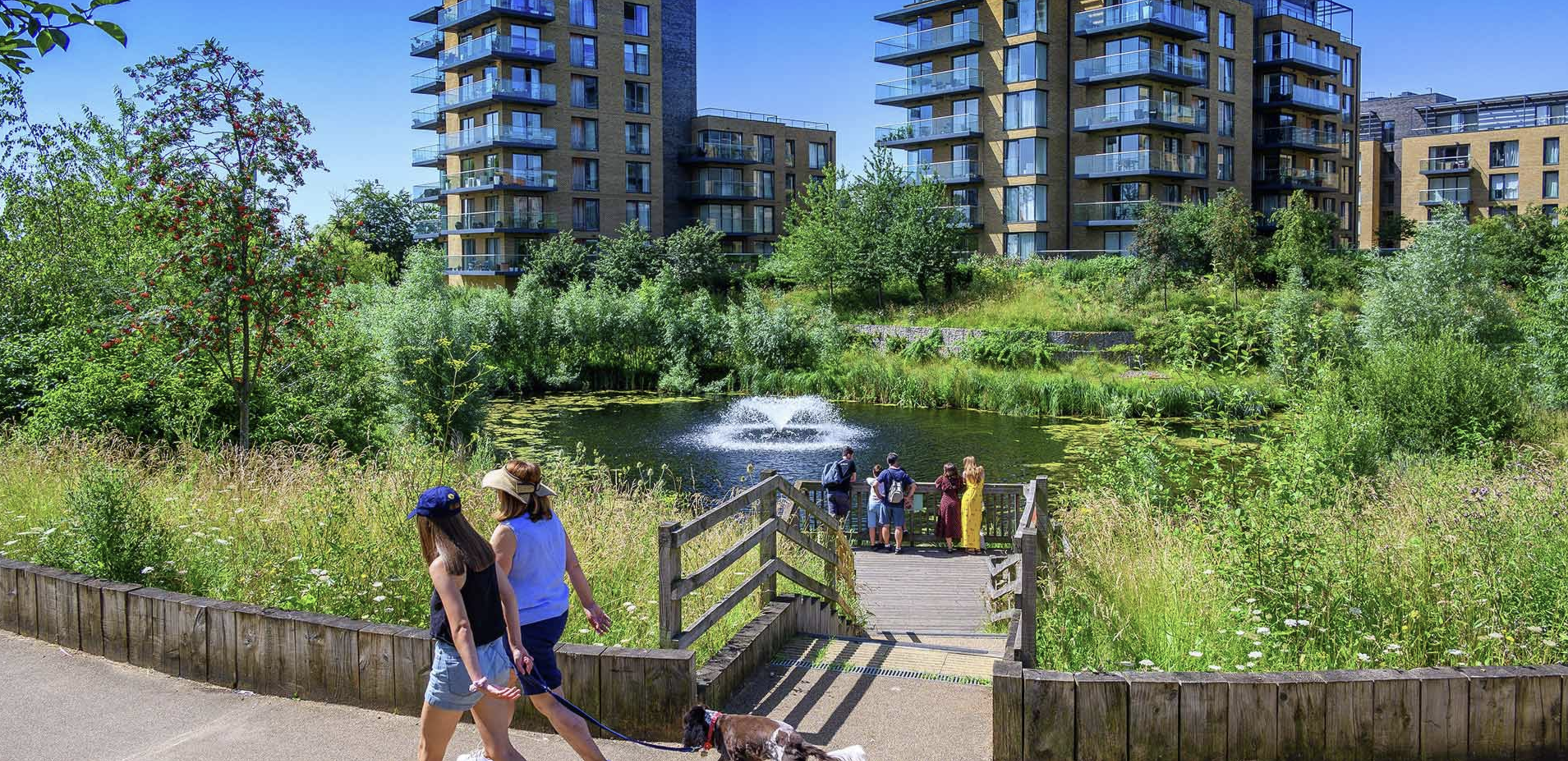

London’s ongoing regeneration and infrastructure development projects are pivotal in shaping its future and enhancing its investment appeal. Major projects such as the regeneration of King’s Cross, the Royal Docks, and Nine Elms are transforming these areas into vibrant, sought-after locations. These developments are not only improving residents’ quality of life but also driving up property values, offering substantial opportunities for capital growth(Turnkey London) (Aspen Woolf).

Infrastructure projects like the Crossrail 2 and the HS2 rail networks are also expected to significantly improve connectivity within London and other parts of the UK. Properties located near these developments are likely to see considerable increases in value, providing international investors with opportunities to capitalise on these growth trends (Aspen Woolf).

Newbrickz: Your Partner in Navigating London’s Property Market

Navigating the London property market can be complex for international investors, mainly because of the UK’s legal and financial requirements. This is where Newbrickz excels, offering tailored guidance and support throughout the investment process. Our team of experts possesses in-depth knowledge of the London market, enabling us to identify high-growth areas and promising investment opportunities that align with our clients’ objectives (Aspen Woolf).

Whether you want to capitalise on London’s solid rental market, leverage the city’s infrastructure developments, or secure financing, Newbrickz provides the expertise and resources needed to make informed decisions and achieve successful outcomes. Our commitment to exceptional customer service ensures that your investment journey in London is rewarding and enjoyable.

Conclusion: London’s Enduring Investment Appeal

London’s real estate market continues to offer unparalleled opportunities for international investors in 2024. The city’s strong capital growth, high rental yields, transparent legal framework, and robust economic stability make it a prime destination for property investment. As London evolves with ongoing regeneration and infrastructure projects, its appeal will only increase, offering substantial returns for those who invest wisely.

For international investors seeking to navigate this dynamic market, Newbrickz stands ready to provide the expert guidance and support needed to make the most of London’s opportunities. Contact us today to begin your journey towards a successful property investment in one of the world’s most vibrant and enduring cities.

Sign Up Now

Want to read more great articles and blogs subscribe to our newsletter